The scale of the U.S. economy is difficult to wrap our minds around, especially when it is summed up by fluctuating graphs and numbers assigned to seemingly random acronyms that report the fiscal success of America and its citizens.

Americans have grown accustomed to the constant hysteria or celebration surrounding the U.S. stock market, a staggering difference in emotions that have only been heightened by the market’s current volatility.

In Donald Trump’s first 100 days in the White House since taking office for a second time, the stock market saw its worst 100-day start to a presidential term since Richard Nixon was inaugurated in 1973. Having an understanding of the stock market, its functionality, and the economic trends that the market indicates allows for a stronger grasp of the current U.S. political and economic landscape.

The stock market, in theory, is a simple concept: Publicly traded U.S. corporations offer an opportunity for investors to sell and purchase shares of their company.

The success of an individual company’s stock is typically a product of its own business performance: When Apple sells iPhones, and Amazon sells their many products, their respective stocks increase in value. However, the market’s fluctuation can be caused by a wide variety of different factors, either directly or indirectly related to the market.

“The stock market is important because it helps companies get money to grow and create jobs,” said Minnehaha senior and economics student Lucas Freeman. “It also lets people invest and try to make money for their future.”

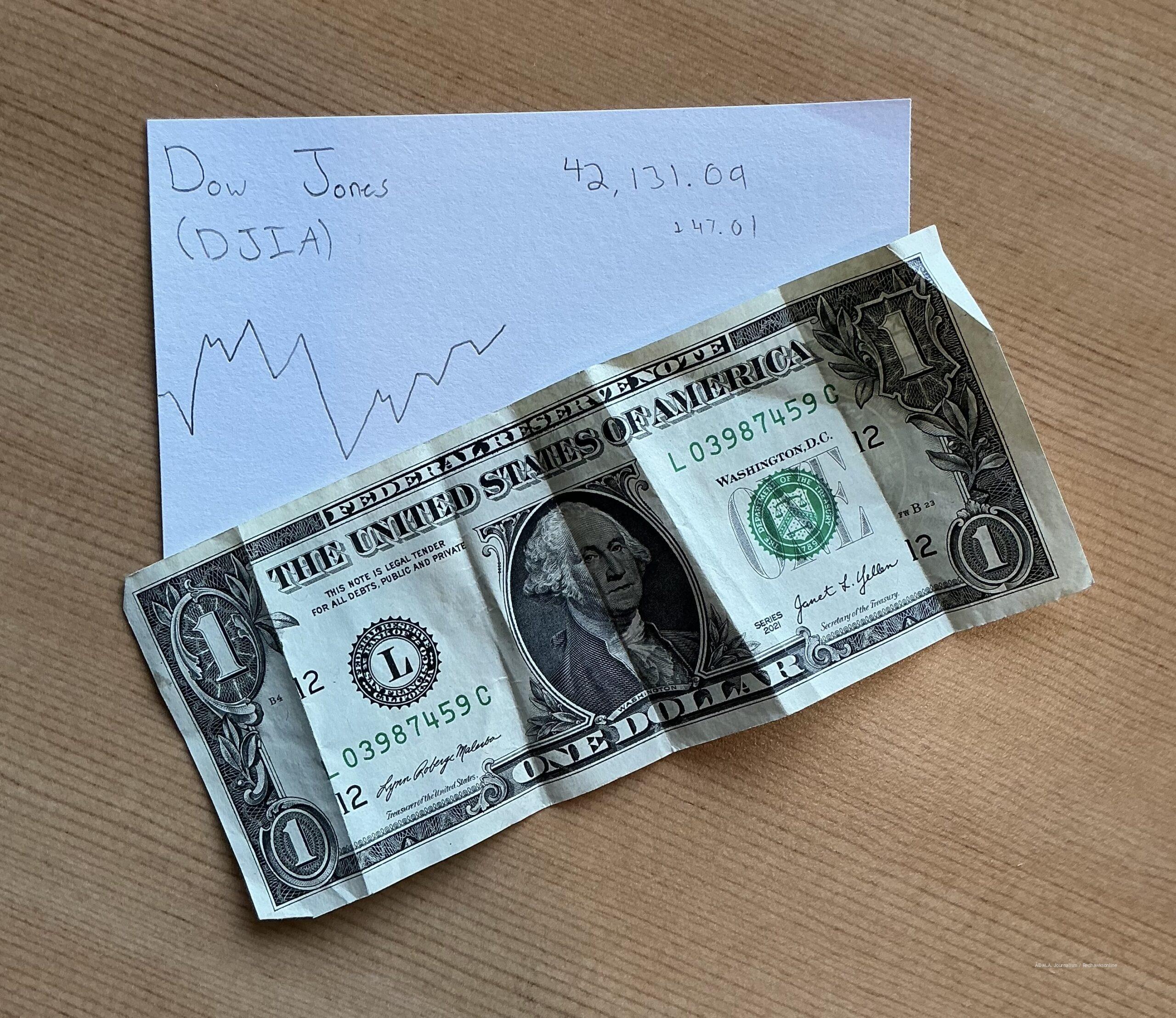

If you check daily market reports in the news, you’ll hear about the Dow Jones Industrial Average (DJIA), the Standard & Poors (S&P) 500, and the NASDAQ, all of which are indexes that report stock market data.

The Dow, an index made-up of 30 blue-chip corporations, is widely considered to be one of the best indicators of market trends. Following Trump’s bold tariff-chatter, the stock market tanked, dropping the Dow 10.9% from April 2 to April 8.

According to the Wall Street Journal, deputy secretary-general of the ICC Andrew Wilson, fears a “downward spiral” of the American economy, the likely result of aggressive tariffs.

Trump’s proposed tariffs — hefty taxes on imported goods from countries such as China — are creating panic within U.S. borders. The stock market serves as a reactionary set of data, directly corresponding to how investors are feeling. Tariffs can often lead to an increase in the cost of goods, sounding off the “sell now” alarm and creating a decrease in market value.

Historically, the major market indexes have shown consistent growth over the long term. According to NerdWallet, the average return from the stock market (using the S&P 500) is around 10% each year. But individual stocks may fail, and the market as a whole isn’t recession-proof. For investors, there is no guarantee that positive trends will continue, and investments are still prone to losses due to the anxious psychology associated with money that can hinder logical investing.

The necessity of money makes investing in the short term a riskier venture. When the market drops, like it has in Trump’s first 100 days, some investors are quick to sell, fearing that the market will drop even more before they turn their liquid assets into cash.

“When markets are down and economic stability is low, consumer confidence can be shaken, and individuals may react by decreasing their spending in general,” said Minnehaha Personal Finance teacher Julie Johnson. “On an individual or household level, this can affect consumption levels of goods and services such as food, clothing, entertainment, housing, transportation, education and more.”

Stock market volatility such as what we are seeing today is a blatant indicator of negative economic trends — it reflects uncertainty within the United States economy, which only creates a more bitter political environment.